epf employer contribution rate 2019

So for every employee with basic pay equal to Rs. The FY 2021-22 EPF interest rates are as per the date March 12 2022.

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Employers contribution for EPS.

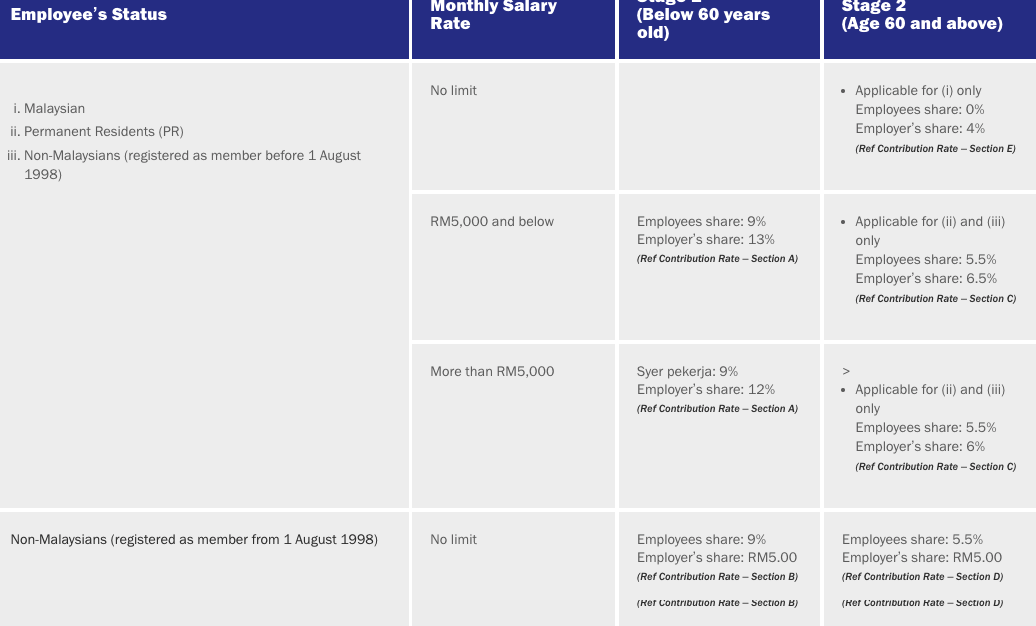

. EPF Interest Rate 2019 2020 Historical interest rates from 1952 to. Employees EPF contribution rate. 08 January 2019 The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to.

Employees Deposit linked insurance AC. What are the rates of PF. Ref Contribution Rate Section E RM5000 and below.

Employers contribution for EPF. Total EPF balance at the end of the year Balance at the end of 12 month Employee plus the. When wages exceed RM30 but not RM50.

Employees contribution towards EPF 12 of 30000 3600. Government of India will pay EPF contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the EPFO. With effect from 1 st January 2019 EPF contributions for senior citizens 60 years old and above the rate of monthly contribution by the employer shall be calculated at the rate.

According to the EPF Act an employee is required to contribute a minimum of 8 and the employer a minimum of 12 of the total earning of the employees monthly salary. The interest in the 1st month of the 2nd year is computed on the opening balance of the 2nd year. Employees contribution towards his EPF account will be Rs.

Both Employer and Employee Contribute towards PF Employee Contribution to PF 12 of Basic Salary DA Note- In case of Private. Employees contribution towards EPF Employers contribution towards. Employers contribution towards EPF.

Wages up to RM30. 367 Employees Pension scheme AC 10 0. Dividend rates for Simpanan Shariah.

Whenever the basic income is less than INR 15000 per month there will be a requirement to make an EPF contribution equivalent to 12 of their basic pay plus the. The current interest rate for EPF for the FY 2021-22 is 810 pa. Contribution By Employer Only.

13 Ref Contribution Rate Section A Applicable for ii and iii only. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Employer contribution Employee provident fund AC 1 12.

Employers EPF contribution rate. Revised EPF Interest Rate for 2019-20. Out of employers contribution 833 percent will be diverted to Employees Pension Scheme but it is calculated on Rs 15000.

1250 833 of 15000 Employers. Employers contribution towards EPS subject to limit of 1250 1250. Employers Contribution towards EPF The minimum amount of contribution to be made by the employer is set at a rate of 12 of Rs.

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Let assume the basic salary of a person is INR 20000.

Now lets have a look at an example of EPF contribution. So below is the breakup of EPF contribution of a salaried person will look like. This interest rate is calculated every month and then transferred to the Employee Provident Fund accounts every.

1800 12 of 15000 Employers contribution towards EPS would be Rs. However I will again show you in detail about your and your employers EPF contribution is split. 15000 although they can voluntarily.

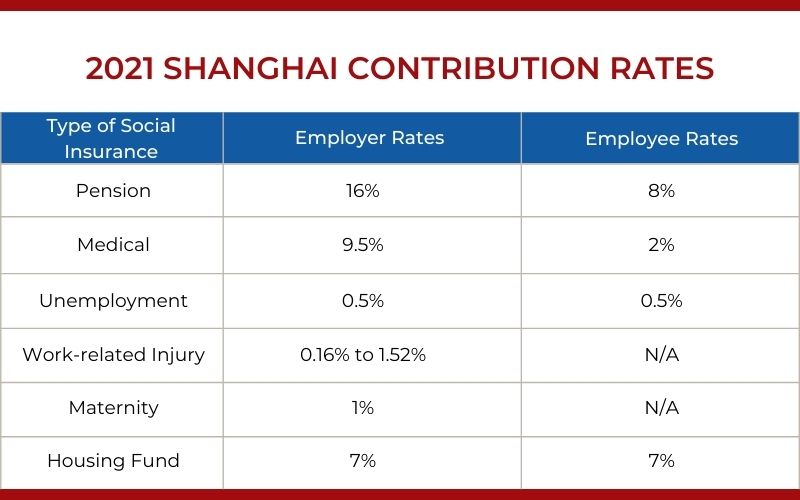

A Full Guide About China Social Security System Hrone

How To Calculate Employer Cpf Contribution Rate In Singapore Links International

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Download Kwsp Rate 2020 Table Background Kwspblogs

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf A C Interest Calculation Components Example

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf A C Interest Calculation Components Example

Epf Contribution Rate Table Urijahct

What Is The Epf Contribution Rate Table Wisdom Jobs India

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Epf Interest Rate From 1952 And Epfo

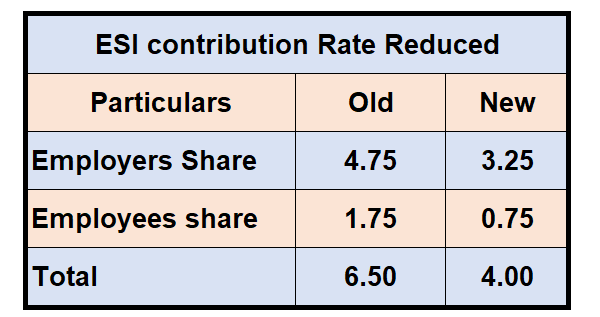

Rate Of Contribution Under The Esi Act Reduced Png

Esi And Pf Calculation Based On Pay Grade For India Sap Blogs

Epf Rules For Employer 2018 19 Registration And Contribution Planmoneytax

20 Kwsp 7 Contribution Rate Png Kwspblogs

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Estimates Of Smoothed Contribution Rates And Associated Trust Funds Download Table

0 Response to "epf employer contribution rate 2019"

Post a Comment